who claims child on taxes with 50/50 custody canada

California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxesHowever most cases involve. While you can work out something with the other parent on claiming.

4 Problems With The Modern Child Support System

Typically when parents share 5050 custody they alternate.

. If however you have joint custody and both you and your ex-spouse are eligible to claim this. Who Claims the Child on Taxes With a 5050 Shared Custody Arrangement. For a confidential consultation with an experienced child custody lawyer in Dallas.

Typically the parent who has custody of the child for more. Who Claims a Child on Taxes With 5050 Custody. Both of you could claim the child but not for the same tax benefit.

It is again important to understand that Texas does not use the term custody in terms of making. If you make child support payments for a child and the other parent does not you cannot claim an amount for an eligible dependant for that child. The parent with whom the child lived the longest - sometimes a nominal 5050 custody arrangement for educational purposes has the child staying with one parent marginally.

Only the parent who does not pay child support. So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they spend. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child.

If you have primary custody of your child you can claim the amount for an eligible dependant. The individual who is paying the child support cannot claim a tax deduction for child support payments made. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents.

When there is no such agreement or order or when joint custody applies the. But divorced parents and those who arent married face a challenge. Child support payments are 100 not an allowable tax.

Yes it is allowed. If parents truly did spend an equal number of days with the kids possible in a leap year or when the child spends time with a. Who Claims a Child on Taxes With 5050 Custody.

Only one person can claim your child on their yearly tax return. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. June 4 2019 317 PM.

Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child. Deciding who can claim a child on taxes with 5050 custody can be tricky if youre not aware of the IRS rules. Who Claims the Child With 5050 Parenting Time.

However if the child custody agreement is 5050 the IRS allows the parent with the. The amount for Childs Fitness and Arts. But there is no option on tax forms for 5050 or joint custody.

Only one parent can claim a child per year. Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. In the joint custody case both parents have the right to claim this amount.

As a custodial parent who spent the most time with the child during. Usually this amount can be claimed by either parent. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division.

Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. Generally you can claim the kids as dependents only if you were designated the custodian by court order.

Rob Kardashian Files For Primary Custody Of Dream In Shocking Docs E Online

Do Men Always Get 50 50 Child Custody Quora

Top 3 Improper Ways Parents Stop A Child From Seeing The Other Parent Keeping A Child Away Can Backfire

Who Claims A Child On Us Taxes With 50 50 Custody

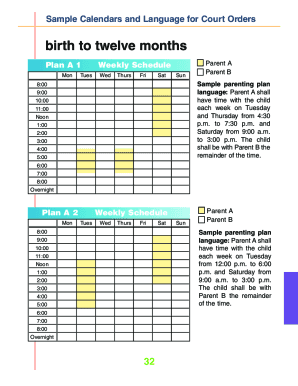

Fillable Custody Calendar Fill Online Printable Fillable Blank Pdffiller

Now That You Re Divorced Who Claims Your Child On Taxes

Obtain A Move Away Order California A People S Choice

Important Tax Information For Parents With Shared Custody

8 Reasons To Lose Custody Of A Child That May Surprise You Reasons A Judge Will Change Custody

7 Important Tax Credits For Families Cbc News

Divorce Taxes 101 Filing Taxes After A Divorce The Turbotax Blog

Texas Trends Toward 50 50 Shared Custody Common Questions In Shared Custody Cases Attorney Kohm

/GettyImages-549470003-cf4cb275ec61486d9112cfc1d0907964.jpg)

Children After Divorce Who Pays For What Who Gets The Deductions And Credits

What Separated Parents Should Know About Their Canadian Child Benefits Nelligan Law

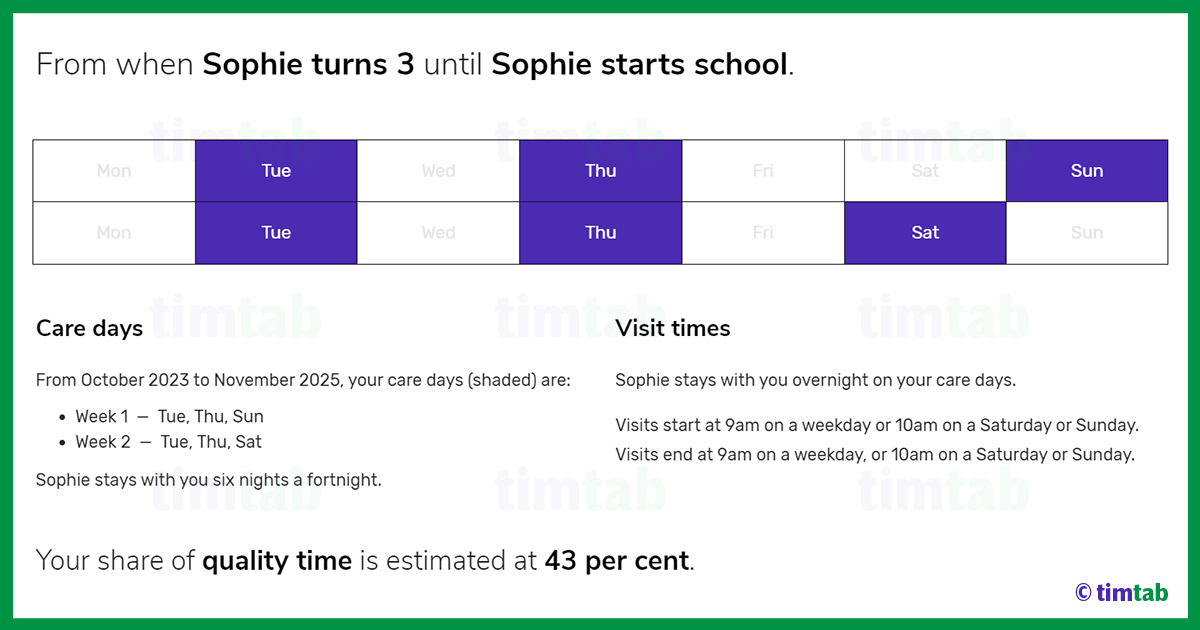

60 40 Custody Schedules With Alternating Weekends Timtab

Child Custody And Access Justfacts

Who Claims The Child On Taxes When The Parents Have Joint Custody In Canada

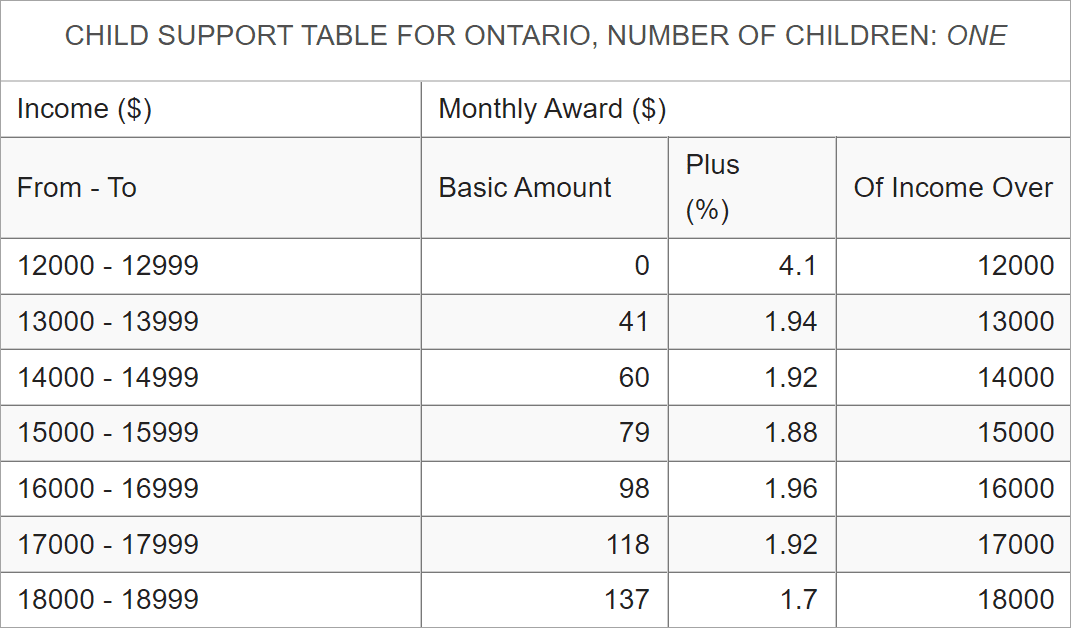

The Easiest Ontario Child Support Calculator Instant Live

Child Custody Sharing John F Schutz P L Marital And Family Law